UK’s economic strife and longevity drive demand for retirement advice

Confidence on accessing retirement funds remains low

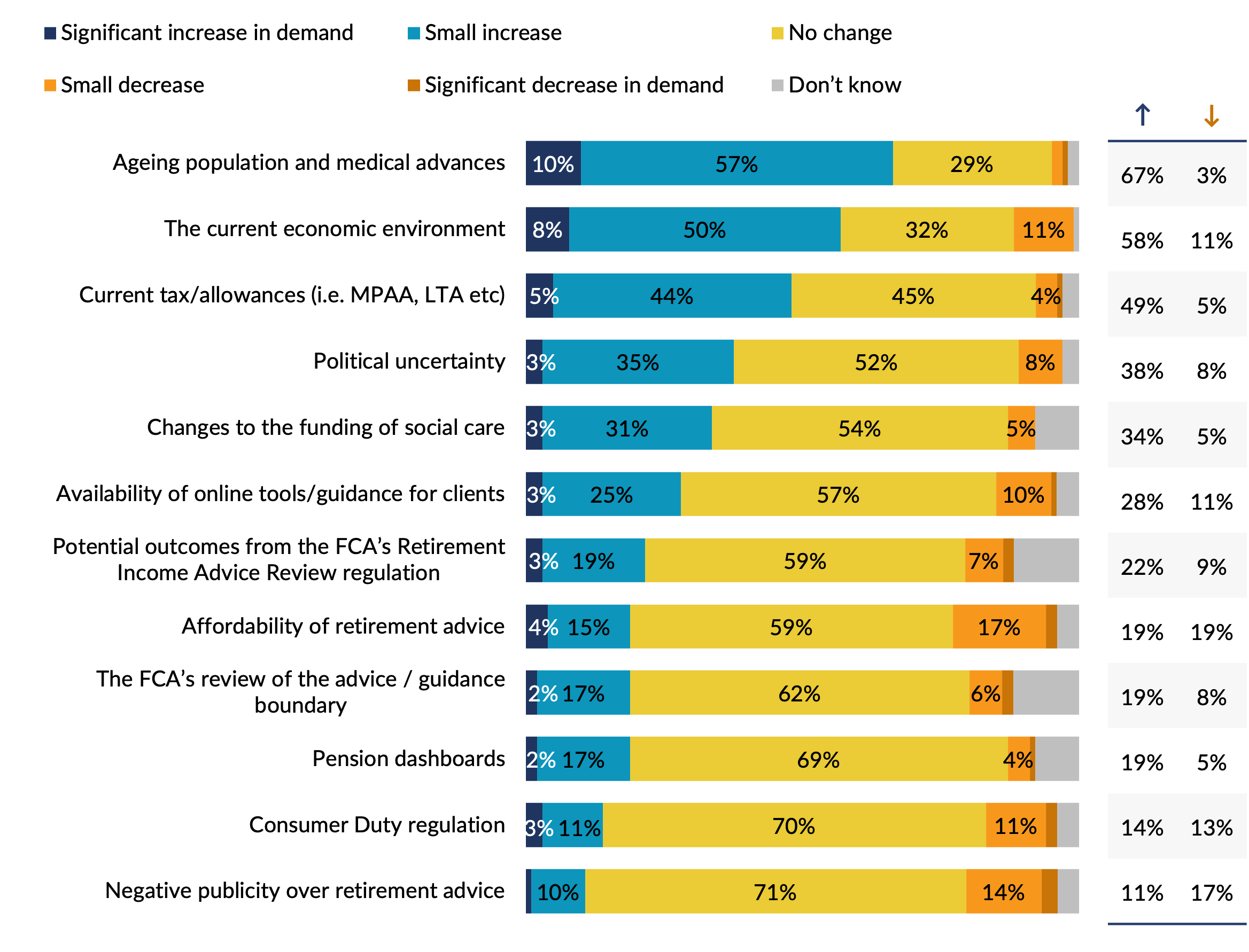

Increased demand for retirement advice is being driven by the UK’s ageing population and continued economic uncertainty, according to latest research.

However, it added that affordability was suppressing demand, an issue reported by 19% of advisers.

The statistics come from the sixth edition of the retirement advice report Managing Lifetime Wealth: Navigating Retirement Advice. The report examined the changing landscape of the retirement advice industry and looked at the influence of recent regulatory and geopolitical events.

Alongside ageing clients and economic turbulence tax changes were also fuelling demand for retirement advice, it said.

The abolition of the lifetime allowance and increased annual allowance rules were cited by 49% of advisers.

Drivers of demand for advice

Source: NextWealth

“Aegon’s Second 50 report further explores the opportunities and challenges created by the prospect of a 100-year, multi-stage life. People are on average living longer and having to bear more of their own financial risks in a defined contribution world, which means that making informed retirement decisions has never been more important or personal to each individual.

“Other key drivers are the current economic climate, and recent changes to pension tax rules and annual allowances. These are creating real pressure to advise affected clients.”

He added: “However, amidst this positive surge, concerns linger. Affordability remains a barrier to retirement advice, with a growing ‘advice gap’. The Financial Conduct Authority (FCA) and Treasury are currently consulting on the Advice Guidance Boundary Review, offering an opportunity to explore simplified advice solutions and targeted support for those currently priced out of receiving help.

“Advisers are also aware that negative headlines and regulatory change such the FCA Consumer Duty could depress demand. While the Consumer Duty may be adding new considerations to the provision of advice, we hope that longer term it will further improve confidence amongst consumers that the advice they are receiving is of consistently good value.”

NextWealth managing director Heather Hopkins commented: “For the sixth year running our research evidences that retirement advice remains a cornerstone of financial planning. It helps clients achieve peace of mind and financial security and is a critical component to the business of financial planning.

“While demand for retirement advice remains strong, there are challenges on the horizon. Concerns about the affordability of financial advice for those who need it most weigh on the minds of many advisers.

“Negative publicity further clouds the landscape, and the ever-shifting regulatory environment adds complexity and cost. This report, kindly sponsored by Aegon, is a testament to the evolving landscape of retirement advice. It’s a reminder that financial planning is about addressing the very real concerns and aspirations of clients.”

Lacking in confidence

Separate research from provider Standard Life highlighted a distinct lack of confidence among clients approaching retirement on their finances.

Standard Life’s Retirement Voice study – which spoke with 6,000 consumers – found just 9% of over 65s felt confident about managing their finances and more than half (52%) were nervous about accessing retirement funds.

It added that almost half (43%) of over-65s did not feel they understood the pros and cons of the various options available to them when taking retirement income, and fewer than one in ten (9%) were confident about how they would access or draw down their retirement funds.

Standard Life managing director for retail direct Dean Butler said: “It’s rather worrying to see so many people fast approaching or even reaching retirement and yet feeling unsure about important areas of their finances.

“Being as informed as possible is key to being able to make good decisions and protect your financial future in retirement. Whether it’s deciding how you’ll take money from your pension, or when to do so, you need an understanding of the options available, and the implications of each on your money in retirement.

“At the moment, seeking advice can seem inaccessible to many, and we’d like to see advice and guidance extended and made more affordable to ensure people can make well-informed decisions.”